Claim collection business refers to the business of receiving money that has been stepped down instead of being delegated to a creditor who has a claim to be received. In addition, the Credit Information Act restricts collection to credit information providers. In the body, we will check with the procedures to see if we can reduce the time and effort of debt collection by receiving money that has been trampled down by debtors who do not repay their debts without justifiable reasons.”Step 3 of debt collection” 執行 Acquisition of executive officers 債務 Investigation of debtors 執行 Investigation of creditors 待つ Investigation of creditors です Waiting if there are other important factors besides seizure and demand.

Claim collection business refers to the business of receiving money that has been stepped down instead of being delegated to a creditor who has a claim to be received. In addition, the Credit Information Act restricts collection to credit information providers. In the body, we will check with the procedures to see if we can reduce the time and effort of debt collection by receiving money that has been trampled down by debtors who do not repay their debts without justifiable reasons.”Step 3 of debt collection” 執行 Acquisition of executive officers 債務 Investigation of debtors 執行 Investigation of creditors 待つ Investigation of creditors です Waiting if there are other important factors besides seizure and demand.

Claim collection business refers to the business of receiving money that has been stepped down instead of being delegated to a creditor who has a claim to be received. In addition, the Credit Information Act restricts collection to credit information providers. In the body, we will check with the procedures to see if we can reduce the time and effort of debt collection by receiving money that has been trampled down by debtors who do not repay their debts without justifiable reasons.”Step 3 of debt collection” 執行 Acquisition of executive officers 債務 Investigation of debtors 執行 Investigation of creditors 待つ Investigation of creditors です Waiting if there are other important factors besides seizure and demand.

Claim collection business refers to the business of receiving money that has been stepped down instead of being delegated to a creditor who has a claim to be received. In addition, the Credit Information Act restricts collection to credit information providers. In the body, we will check with the procedures to see if we can reduce the time and effort of debt collection by receiving money that has been trampled down by debtors who do not repay their debts without justifiable reasons.”Step 3 of debt collection” 執行 Acquisition of executive officers 債務 Investigation of debtors 執行 Investigation of creditors 待つ Investigation of creditors です Waiting if there are other important factors besides seizure and demand.

▣If you want to receive the money that has been trampled down, get it from the executive officer!A document that allows a creditor to enforce a claim against a debtor under the compulsory power of the state is called an executive officer. This is a basic document necessary as a source of seizure and execution against debtors, and in the case of civil claims between individuals, it is also a condition for requesting investigation and collection of credit information companies.”I’d like to receive the money, but I’d like to seize it, but I have a loan certificate and a breakdown of the account transfer…In such cases, there are few enforcement procedures that ordinary creditors can do. “Type of Executive Officer” (i) Final judgment with a final final and provisional sentence of execution (ii) Final payment order (iii) Notarized document stating the debtor’s acceptance of execution.④All executives, except 賠償 judgment of compensation and 番 notarized office visit, etc., are submitted by the court at the request of the creditor (the plaintiff), and no matter how frustrating the case may be, there is no procedure to rescue the creditor.

▣If you want to receive the money that has been trampled down, get it from the executive officer!A document that allows a creditor to enforce a claim against a debtor under the compulsory power of the state is called an executive officer. This is a basic document necessary as a source of seizure and execution against debtors, and in the case of civil claims between individuals, it is also a condition for requesting investigation and collection of credit information companies.”I’d like to receive the money, but I’d like to seize it, but I have a loan certificate and a breakdown of the account transfer…In such cases, there are few enforcement procedures that ordinary creditors can do. “Type of Executive Officer” (i) Final judgment with a final final and provisional sentence of execution (ii) Final payment order (iii) Notarized document stating the debtor’s acceptance of execution.④All executives, except 賠償 judgment of compensation and 番 notarized office visit, etc., are submitted by the court at the request of the creditor (the plaintiff), and no matter how frustrating the case may be, there is no procedure to rescue the creditor.

▣If you want to receive the money that has been trampled down, get it from the executive officer!A document that allows a creditor to enforce a claim against a debtor under the compulsory power of the state is called an executive officer. This is a basic document necessary as a source of seizure and execution against debtors, and in the case of civil claims between individuals, it is also a condition for requesting investigation and collection of credit information companies.”I’d like to receive the money, but I’d like to seize it, but I have a loan certificate and a breakdown of the account transfer…In such cases, there are few enforcement procedures that ordinary creditors can do. “Type of Executive Officer” (i) Final judgment with a final final and provisional sentence of execution (ii) Final payment order (iii) Notarized document stating the debtor’s acceptance of execution.④All executives, except 賠償 judgment of compensation and 番 notarized office visit, etc., are submitted by the court at the request of the creditor (the plaintiff), and no matter how frustrating the case may be, there is no procedure to rescue the creditor.

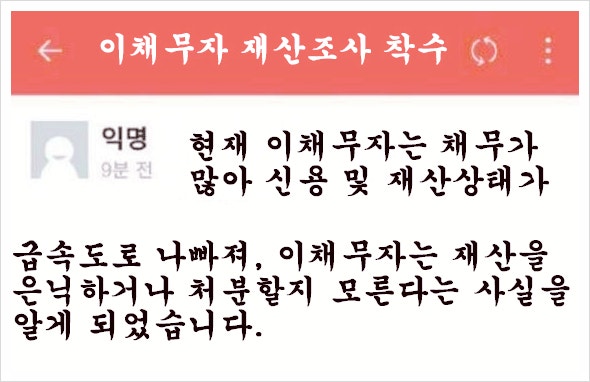

▣After understanding the reality through the debtor investigation, proceed with seizure and collection!Sometimes, we talk about whether it is easy to receive a judgment because there is a judgment document among creditors. In the debt collection industry, a judgment is a requirement for a single executive officer, and nothing less. However, the biggest difference between those who have executive power and those who do not is “debtor credit and property investigation.”Creditors with a confirmed executive officer may make a credit inquiry of the debtor without the debtor’s consent. We need the appropriate procedures and documents, but it is true that they are possible. In many cases, external factors of debtors affect recovery, but the reality is that 70 to 80 percent of the data collected is proportional to the survey results.The more default registrations are made, the more debtors exist, and someone else besides this creditor periodically exercises their claims against the same debtor.財産 Classify debtors through investigation を Debtor who has property and is easy to recover.②A debtor with no assets but good credit standing 状態 A person who has a history of defaulters but has a high willingness to repay their debts.④Investigations other than the four above may change the direction of collection of claims that can be carried out by actual debtors, such as multiple debtors, willingness to repay, and ability settleers.

▣After understanding the reality through the debtor investigation, proceed with seizure and collection!Sometimes, we talk about whether it is easy to receive a judgment because there is a judgment document among creditors. In the debt collection industry, a judgment is a requirement for a single executive officer, and nothing less. However, the biggest difference between those who have executive power and those who do not is “debtor credit and property investigation.”Creditors with a confirmed executive officer may make a credit inquiry of the debtor without the debtor’s consent. We need the appropriate procedures and documents, but it is true that they are possible. In many cases, external factors of debtors affect recovery, but the reality is that 70 to 80 percent of the data collected is proportional to the survey results.The more default registrations are made, the more debtors exist, and someone else besides this creditor periodically exercises their claims against the same debtor.財産 Classify debtors through investigation を Debtor who has property and is easy to recover.②A debtor with no assets but good credit standing 状態 A person who has a history of defaulters but has a high willingness to repay their debts.④Investigations other than the four above may change the direction of collection of claims that can be carried out by actual debtors, such as multiple debtors, willingness to repay, and ability settleers.

▣Think and judge from the debtor’s point of view rather than from the creditor’s point of view!Creditors who have to sue, seize, or execute money for being trampled down can be under double stress over additional costs and time rather than feeling refreshed. Therefore, even if a seizure is to be carried out, psychological warfare must be carefully considered from the debtor’s point of view.For example, the timing of seizure will be taken into consideration for debtors who do not have property but have no history of default registration but are not sure to seize it immediately, and debtors who already use local agricultural cooperatives, credit cooperatives, and Saemaul banks.The procedure described so far must be repeated until the time of collection. In other words, it disproves the need for management. Many claims are disposed of in a short period of time, but most of them are medium- and long-term loans, and this is also the reason why we ask specialized debt collection companies to collect them.

▣Think and judge from the debtor’s point of view rather than from the creditor’s point of view!Creditors who have to sue, seize, or execute money for being trampled down can be under double stress over additional costs and time rather than feeling refreshed. Therefore, even if a seizure is to be carried out, psychological warfare must be carefully considered from the debtor’s point of view.For example, the timing of seizure will be taken into consideration for debtors who do not have property but have no history of default registration but are not sure to seize it immediately, and debtors who already use local agricultural cooperatives, credit cooperatives, and Saemaul banks.The procedure described so far must be repeated until the time of collection. In other words, it disproves the need for management. Many claims are disposed of in a short period of time, but most of them are medium- and long-term loans, and this is also the reason why we ask specialized debt collection companies to collect them.

▣Think and judge from the debtor’s point of view rather than from the creditor’s point of view!Creditors who have to sue, seize, or execute money for being trampled down can be under double stress over additional costs and time rather than feeling refreshed. Therefore, even if a seizure is to be carried out, psychological warfare must be carefully considered from the debtor’s point of view.For example, the timing of seizure will be taken into consideration for debtors who do not have property but have no history of default registration but are not sure to seize it immediately, and debtors who already use local agricultural cooperatives, credit cooperatives, and Saemaul banks.The procedure described so far must be repeated until the time of collection. In other words, it disproves the need for management. Many claims are disposed of in a short period of time, but most of them are medium- and long-term loans, and this is also the reason why we ask specialized debt collection companies to collect them.

▣Think and judge from the debtor’s point of view rather than from the creditor’s point of view!Creditors who have to sue, seize, or execute money for being trampled down can be under double stress over additional costs and time rather than feeling refreshed. Therefore, even if a seizure is to be carried out, psychological warfare must be carefully considered from the debtor’s point of view.For example, the timing of seizure will be taken into consideration for debtors who do not have property but have no history of default registration but are not sure to seize it immediately, and debtors who already use local agricultural cooperatives, credit cooperatives, and Saemaul banks.The procedure described so far must be repeated until the time of collection. In other words, it disproves the need for management. Many claims are disposed of in a short period of time, but most of them are medium- and long-term loans, and this is also the reason why we ask specialized debt collection companies to collect them.Previous Image Next ImagePrevious Image Next ImagePrevious Image Next Image